Dream of sandy beaches, mountain climbing, or fresh city discovery. Rest and relaxation call for vacations. While planning can be enjoyable, the associated costs can quickly turn it into stress. Vacation Budget Planners can be of good use to someone going on vacation.

This blog will motivate you to create a vacation budget plan that allows you to afford your ideal trip and return home free from financial regrets. We will go over the best saving strategies, financial planning, and common budgeting mistakes.

Why is the vacation budget planner important?

Let’s talk about why a vacation budget planner is so important before we discover how.

- A vacation budget planner shows you how much your trip will cost, thereby helping you to prevent overspending.

- Strong financial plans help you enjoy your holiday without financial concerns.

- A vacation budget template helps break travel objectives into more manageable pieces.

- Setting priorities helps you decide what you may remove from your vacation plans and what is absolutely required for financial allocation.

- Monitoring your savings can help you maintain your plan.

- Methodical Approach: Create a Vacation Planning Budget

Step-by-Step Guide to Creating Your Vacation Budget Planner

1. Set Your Financial Goals and Determine Your Trip’s Scope

- Define Your Destination and Duration: Where do you want to go, and how long will you stay? This is the foundation for your entire vacation budget planner. Be specific. “A beach vacation” is less helpful than “A 7-day trip to Cancun.”

- Establish a Realistic Budget: Consider your current financial situation, income, and other financial commitments. Be honest with yourself about how much you can realistically afford. This information is crucial for setting achievable financial goals.

2. Estimate Your Major Expenses

This phase is where your vacation budget template starts to take shape. Divide your expenses into categories:

Transportation:

- Flights: Research flight costs using various search engines and consider alternative airports or travel dates.

- Ground Transportation: Include costs for rental cars, taxis, public transportation, airport transfers, or train tickets.

- Gas/Tolls: If driving, estimate fuel consumption and potential toll fees.

Accommodation:

- Hotels/Resorts: Research hotel prices in your chosen destination. Consider different types of accommodation, such as vacation rentals, hostels, or guesthouses, to find options that fit your budget.

- Airbnb/Vacation Rentals: Explore options on platforms like Airbnb or VRBO, which can sometimes offer more affordable and spacious accommodations, especially for families or groups.

Food and Drinks:

- Restaurants: Estimate how much you’ll spend on meals. Consider a mix of dining out and cooking some meals yourself to save money.

- Groceries: If you plan to cook, research grocery prices in your destination.

- Snacks and Drinks: Factor in the cost of snacks, beverages, and alcoholic drinks.

Activities and Entertainment:

- Sightseeing: Research entrance fees for attractions, museums, and historical sites.

- Tours: If you plan to take any guided tours, factor in the cost.

- Entertainment: Include costs for shows, concerts, or other forms of entertainment.

- Excursions: Plan for any day trips or special outings.

Travel Insurance:

- Comprehensive Coverage: It’s highly recommended to purchase travel insurance to protect yourself against unexpected events like trip cancellations, medical emergencies, or lost luggage.

Visas and Passport Fees:

- Application Costs: If your destination requires a visa, research the application fees.

- Passport Renewal: Ensure your passport is valid for at least six months beyond your return date. If not, factor in the cost of renewal.

Miscellaneous Expenses:

- Souvenirs: Set a budget for gifts and souvenirs.

- Shopping: If you plan to do any shopping, allocate a specific amount.

- Tips: Factor in tipping customs in your destination.

- Unexpected Costs: It’s always a beneficial idea to include a buffer for unexpected expenses that may arise during your trip.

3. Create Your Vacation Budget Template

Now it’s time to put all your estimates into a structured vacation budget template. You can use a spreadsheet program like Google Sheets or Microsoft Excel, a budgeting app, or even a simple notebook.

Spreadsheet Method:

- Create columns for each expense category (Transportation, Accommodation, etc.).

- List specific expenses within each category (flights, hotels, etc.).

- Enter your estimated costs for each expense.

- Use formulas to calculate the total estimated cost, total actual cost, and the difference between them.

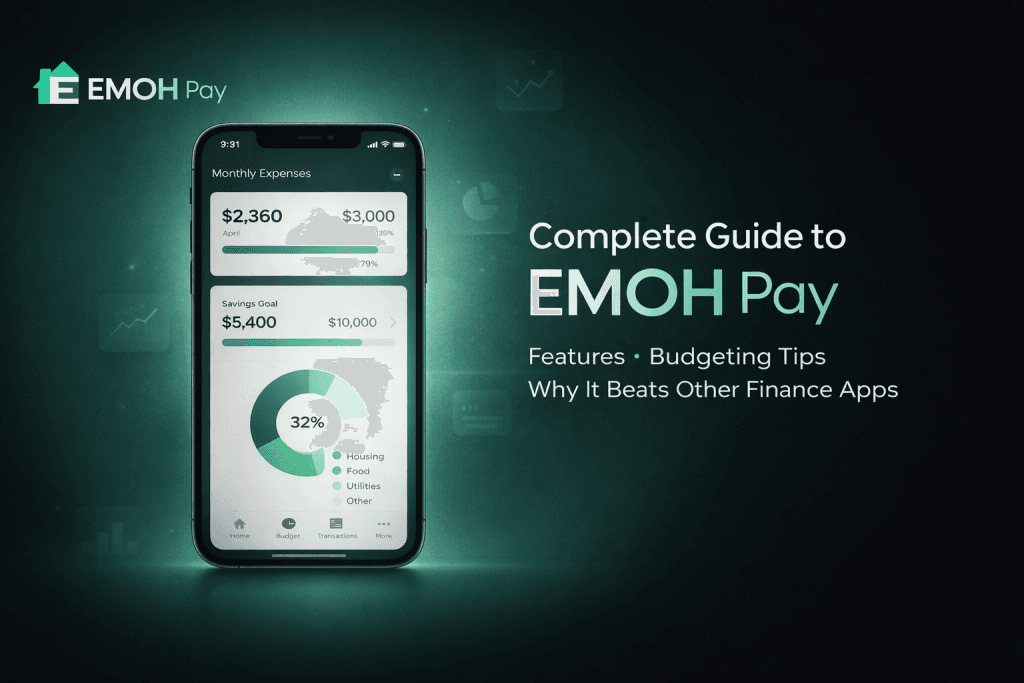

Budgeting Apps:

- Many budgeting apps offer features specifically designed for travel budgeting. These apps can help you track your spending, categorize expenses, and even convert currencies.

Notebook Method:

- If you prefer a more traditional approach, you can create a vacation budget planner in a notebook.

- Divide your notebook into sections for each expense category.

- List your estimated costs and track your actual spending as you go.

4. Implement Best Saving Strategies

Once you have your vacation budget template, it’s time to start saving! Here are some best saving strategies to help you reach your financial goals:

- Create a Dedicated Savings Account: Open a separate savings account specifically for your vacation fund. This step will help you keep your vacation savings separate from your regular savings.

- Automate Your Savings: Set up automatic transfers from your checking account to your vacation savings account. Even small, regular transfers can add up quickly.

5. During Your Vacation: Stick to Your Budget

Your vacation budget planner isn’t just for pre-trip planning; it’s also a valuable tool during your vacation.

- Track Your Spending: Use a budgeting app or a small notebook to track your expenses each day. This method will help you stay within your budget and avoid overspending.

- Be Mindful of Your Spending Choices: Make conscious decisions about how you spend your money. Choose affordable dining options, take advantage of free activities, and avoid impulse purchases.

- Use Cash When Possible: Using cash can help you stay within your budget by making it easier to visualize how much you’re spending.

- Don’t Be Afraid to Say No: If an activity or purchase doesn’t align with your budget, don’t be afraid to say no.

Easy Budgeting Tips for Couples

Planning a vacation as a couple requires effective communication and collaboration. Here are some easy budgeting tips specifically for couples:

- Have Open and Honest Conversations: Discuss your financial goals, priorities, and spending habits openly and honestly.

- Create a Couples Budget Planner: Work together to create a couples budget planner It reflects both your needs and preferences.

- Make Joint Decisions: Discuss and agree on major spending decisions together.

- Regularly Review the Budget Together: Schedule regular check-ins to review your progress and make any necessary adjustments.

Building a Strong Financial Foundation for Future Travels

Creating a vacation budget planner is a great way to manage your finances for a specific trip, but it’s also important to build a strong financial foundation for future travels and overall financial well-being.

- Create a Household Budget: Develop a comprehensive household budget that includes all your income and expenses. This process will help you track your spending, identify areas where you can save, and allocate funds for your travel goals.

- Invest for the Future: Consider investing a portion of your income for long-term financial goals, such as retirement.

Common Budgeting Mistakes to Avoid

Even with the best intentions, it’s easy to make common budgeting mistakes. Here are some to watch out for:

- Underestimating Costs: Be realistic and thorough when estimating your expenses. It’s better to overestimate than underestimate.

- Forgetting Miscellaneous Expenses: Don’t forget to factor in smaller expenses, such as tips, souvenirs, and snacks.

- Not Tracking Spending: Failing to track your spending can quickly lead to overspending.

- Impulse Purchases: Avoid making impulsive purchases, especially during your vacation.

- Not Being Flexible: Be prepared to adjust your plans if necessary to stay within your budget.

Conclusion

A smart vacation budget planner is your friend for allowing your dream trip without compromising your financial objectives.

Following these proven financial tips, using the best saving strategies, and avoiding common budgeting mistakes will help you create a strong financial foundation, travel stress-free, and return home with amazing memories and a healthy bank account. To keep neat, use a vacation or trip budget template or planner. Happy planning and vacation!