Developing a strong financial foundation for your family is one of the most essential steps you can take to ensure long-term stability and security. A solid foundation not only helps you manage day-to-day expenses but also gets you ready for so many challenges and future goals. Whether you are just starting or looking to make your situation better, in this guide, we will provide you with some important steps, proven financial tips, and strategies to build a financial foundation for families that lasts.

Why a Strong Financial Foundation Matters

A strong financial foundation is one of the keystones of a stress-free and flourishing family life. It helps you to:

- Achieve your financial goals, like purchasing a home, saving for your children’s education, or planning for retirement.

- Effectively manage the household budget without relying on paychecks.

- Build financial security for families to handle emergencies like medical bills or job loss.

- Foster financial literacy for families, teaching your children the value of money and smart spending habits.

Without a strong financial plan, families get stuck in debt, overspend, and worry. The good news is that with the proper approach, you can get a grip on your finances and create a better future.

Step 1: Set Clear Financial Goals

The first thing to do when developing a strong financial foundation is to establish your financial objectives. Your financial objectives will be your guide through your family’s financial life. Begin by dividing your objectives into short-term, medium-term, and long-term:

- Short-term objectives: Eliminating credit card debt, building an emergency fund, or saving for a vacation.

- Medium-term objectives: Saving for a home down payment or paying for a child’s education.

- Long-term objectives: Retirement savings or creating wealth that lasts across generations.

Having clear objectives assists in helping you create spending and saving priorities so that each dollar you make is working towards something positive.

Step 2: Create a Household Budget

A family budget is a strong financial foundation. It helps you monitor your income and expenses, determine areas where you can shave expenses, and put money towards your financial objectives. Here’s where to begin:

List Your Income: Count all income sources, including wages, bonuses, and extracurricular activities.

Track Your Expenses: Break your spending into fixed costs (rent, utilities) and variable costs (dining out, entertainment).

Set Spending Limits: Utilize tools such as a couples budget planner to get both partners in agreement.

Review and Adjust: Frequently check your budget to make sure it meets your goals.

For further advice, see these easy budgeting tips to keep it easy and on track.

Step 3: Build an Emergency Fund

Life is full of surprises, and an emergency fund is a vital element of financial security for families. Try to save 3-6 months’ living costs in a separate, liquid account. These savings will serve as a buffer in situations such as the loss of a job, a medical condition, or a roof repair.

Step 4: Manage Family Expenses Wisely

Managing family expenses is not straightforward with an increase in the cost of living. Follow these tips to maintain control over your expenses:

- Needs Over Wants: Distinguish between necessary expenses and discretionary spending.

- Cashback and Rewards: Leverage credit card rewards or cashback offers on daily purchases.

- Meal and Grocery Planning: Meal planning will cut food costs by a major margin and reduce food wastage.

By being careful with your spending, you can release more money to invest in your financial objectives.

Step 5: Invest in Financial Literacy for Families

One of the greatest presents you can bestow on your family is financial literacy. Educating your children on managing money, saving, and investing prepares them for future success. Here’s how to begin:

- Lead by Example: Demonstrate to your children how you budget, save, and make money choices.

- Use Allowances as Teaching Tools: Provide your children with a small allowance and teach them to save part of it.

- Discuss Financial Issues: Speak freely about issues such as debt, investing, and the value of saving.

Step 6: Plan for the Future

Financial planning is crucial for long-term stability. Consider hiring a financial advisor to develop a complete plan that incorporates:

- Retirement Savings: Save regularly in retirement accounts such as 401(k)s or IRAs.

- Insurance: Have sufficient health, life, and disability insurance to cover your family.

- Estate Planning: Make a will and name beneficiaries to secure your family’s future.

Proven Financial Tips to Strengthen Your Foundation

Here are some tested money tips to ensure that you build and sustain a strong financial foundation:

- Automate Savings: Automate transfer to your savings and investment accounts.

- Avoid Lifestyle Inflation: When your income increases, avoid the temptation to raise your expenditure accordingly.

- Pay Off High-Interest Debt: Prioritize paying off credit card debt and other high-interest loans.

- Diversify Investments: Invest across various asset classes to minimize risk.

- Review Your Finances Regularly: Set a monthly or quarterly review to monitor your progress.

Tools to Help You Succeed

It’s simpler to build a strong financial foundation with the right resources. Try using:

Couples Budget Planner: A joint budgeting tool to get on the same page as a team financially.

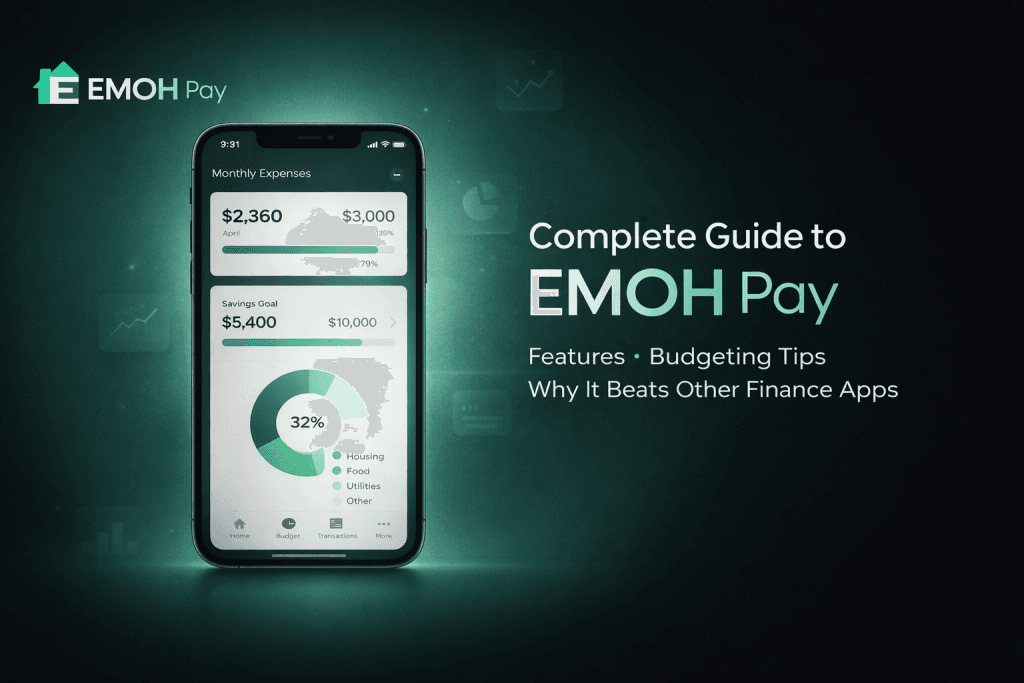

Budgeting Apps: Mint or YNAB can keep your spending in check and you on budget.

Financial Calculators: Employ online calculators to budget for retirement, savings, or paying off debt.

Conclusion

Developing a strong financial foundation for your family is a thing that needs commitment, discipline, and patience. By setting clear financial goals, creating a household budget, and planning smart money management for families, you can accomplish financial stability and security. Remember, the key to success is a need to adapt as your family needs evolve.

Start today by implementing these proven financial tips and take the first step towards a great financial future for your family. With the right mindset and tools, you can develop a legacy of financial security for families that lasts for a long time.